Surging demand for Southern Highlands, fastest growth in 30 years

There is no doubt that March saw much higher than normal activity throughout the Southern Highlands market. Transaction numbers were high, prices are strong, and in some cases, the results may seem hard to fathom.

Of course, there are many factors influencing these outcomes. Low interest rates, with the promise they will stay low for quite a while, higher than usual household savings rates, and exceptionally strong demand from Sydney buyers who are absolutely in love with the idea of moving to Mittagong, Bowral and Burradoo (in particular). The regional relocation we’re experiencing locally is part of an Australia-wide COVID phenomenon, with many jobs now able to be performed remotely.

Whilst the number of new listings coming to the market is actually higher than usual, inventory remains at five-year lows. Fear of missing out (FOMO) is driving very quick decision making, fast transactions, and above market prices in most market segments.

All of these are factors contributing to a very strong market. The big question is: is this buoyancy temporary (like 2003), or have we moved up to a newly sustainable level in property values? Nobody knows. We will just have to wait and see.

Fastest Market Growth since 1988

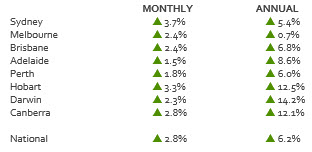

According to CoreLogic, Australian home values increased 2.8% in March, producing the fastest rate of growth Australia has seen since October 1988.

This has enabled Sydney & Melbourne, the two largest components of Australia’s marketplace - jointly comprising more than 50% of transactions - to stage a full recovery from earlier downturns. But the recovery is also broad based, with all capital cities and ‘rest of state’ areas rising by 1.4%.

Sydney gained 3.7% over the month, leading to a 6.7% gain over the first quarter of the year. Melbourne gained 2.4%, making it the last capital city to move back into positive annual growth. Across Australia’s regions, NSW also performed the most strongly, with values gaining a strong 2.8%.

The strength of prices growth remains heavily driven by supply shortages, now running at 25.5% below the five-year average. However, the trend in newly advertised homes over the past four weeks, is now at above average levels – 8.1% higher than a year ago.

Nationally, house values rose 3% in March whereas units rose a more modest 1.9% - highlighting a return to more traditional tastes in property throughout the country. Clearly, we’re not done with the quarter-acre block and Hills Hoist just yet! Across the combined capitals, the quarterly rate of growth for houses was 6.5%, more than double that of units at 3.1%.

However, unit owners should not despair. Despite this general underperformance, apartments have turned a corner. In Sydney there have been two consecutive months of rising values. In Melbourne, prices have been steadily rising since October last year – and the trend has accelerated in recent months.

Monthly change in capital city home values

FOMO persists

Demand continues to exceed newly advertised supply. Currently, for every new listing added to the market, 1.1 homes are sold. This strong rate of absorption is keeping inventory levels low and fuelling fear of missing out (FOMO). However, as previously mentioned the trend is improving.

Premium market drives acceleration in capital gains

Across the combined capitals, the upper quartile of the market recorded a 3.7% lift in values in March, while the lower quartile was up less than half this rate at 1.6%.

This trend is most evident across the three largest capitals. In Sydney, upper quartile home values were 4.8% higher over the month compared with the 2.2% lift in values seen across the lower quartile. Similarly in Melbourne, the upper quartile (2.8%) outpaced the lower quartile (1.6%), while Brisbane’s upper quartile index (3.1%) rose at nearly triple the rate of lower quartile values (1.1%).

Previously, it was premium value properties that were leading the downturn in these same markets. However, more recently this trend has reversed as buyers take advantage of improving economic conditions and record low interest rates.

So, what does all of this mean for the value of your home in Mittagong, Bowral, East Bowral or Burradoo?

With the market in this state, it is hard even for us to keep up. But, as always, because our sales executives are in it all day, every day, your best source for information is them. So please call Allan (0408 448 240) , Anna (0457 448 240), Reece (0423 851 197) or Julie (0432 642 665) if you’d like to know how the value of your home has changed. We’ll be happy to provide an appraisal, whether you’re ready to sell or not.

-

over 1 year agoTrends, takeaways, and reflections on the property market in 2023, and what to expect for the year ahead

-

over 1 year agoYour holiday guide for the biggest holiday of the year

-

over 1 year agoRental markets remain “EXTREMELY TIGHT”